Fortitude Financial Group Fundamentals Explained

Fortitude Financial Group Fundamentals Explained

Blog Article

Fascination About Fortitude Financial Group

Table of ContentsFortitude Financial Group Can Be Fun For EveryoneThe Basic Principles Of Fortitude Financial Group The Greatest Guide To Fortitude Financial GroupFortitude Financial Group for DummiesFortitude Financial Group - Truths

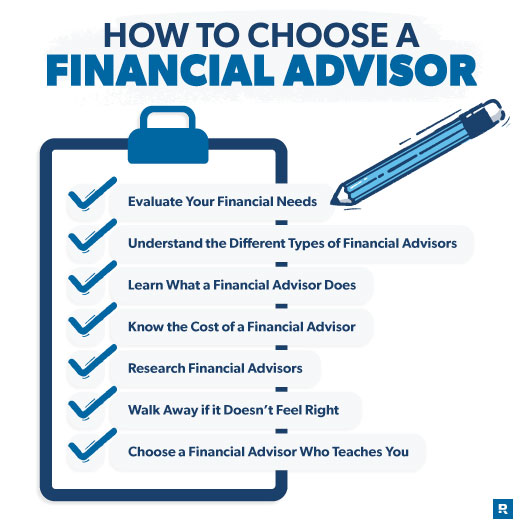

Costs will certainly also vary by place and the consultant's experience. Some experts might offer lower rates to assist customers that are simply beginning with financial planning and can't afford a high regular monthly rate. Normally, a financial consultant will certainly use a complimentary, initial examination. This appointment supplies a chance for both the customer and the advisor to see if they're an excellent suitable for each other.A fee-based monetary consultant is not the very same as a fee-only monetary expert. A fee-based advisor might make a charge for developing a monetary plan for you, while also earning a compensation for offering you a certain insurance coverage product or financial investment. A fee-only economic consultant earns no compensations. The Securities and Exchange Payment (SEC) suggested its own fiduciary guideline called Regulation Benefit in April 2018.

Robo-advisors do not require you to have much cash to obtain started, and they set you back much less than human monetary experts. A robo-advisor can not speak with you about the ideal method to get out of financial debt or fund your kid's education. Investment Planners in St. Petersburg, Florida.

6 Simple Techniques For Fortitude Financial Group

Robo-advisors generally spend customers' money in a profile of exchange-traded funds (ETFs) and mutual funds that give supply and bond exposure and track a market index. It's also crucial to remember that if you have a complicated estate or tax issue, you will likely require the extremely personalized recommendations that just a human can offer.

A consultant can assist you figure out your savings, exactly how to construct for retired life, aid with estate planning, and others. If however you only need to go over profile appropriations, they can do that too (typically for a charge). Financial consultants can be paid in a number of methods. Some will certainly be commission-based and will certainly make a percent of the items they guide you right into.

Many monetary advisors function for a percent charge based on the amount they are responsible for. Also though you might not be accountable for any type of upfront fees, a financial expert can make a percent of your principal, compensations on what products they offer you, and occasionally also a portion of your revenues.

This isn't to say the person making use of the consultant is losing anything, however the advisor, and who they work, for will always discover a method to revenue. Not all monetary consultants have the exact same degree of training or will certainly provide you the same deepness of solutions. So when contracting with a consultant, do your own due persistance to ensure the advisor can satisfy your financial preparation needs.

Rumored Buzz on Fortitude Financial Group

Ramsey Solutions is not connected with any kind of SmartVestor Pros and neither Ramsey Solutions neither any of its representatives are authorized to provide financial investment advice in behalf more information of a SmartVestor Pro or to substitute or bind a SmartVestor Pro. Each SmartVestor Pro has actually become part of an agreement with Ramsey Solutions under which the Pro pays Ramsey Solutions a mix of fees.

The existence of these plans might impact a SmartVestor Pro's desire to work out below their typical financial investment consultatory fees, and consequently might impact the overall costs paid by customers presented by Ramsey Solutions through the SmartVestor program. Please ask your SmartVestor Pro to find out more concerning their charges (Financial Advisor in St. Petersburg). Neither Ramsey Solutions neither its affiliates are taken part in supplying financial investment recommendations

Ramsey Solutions does not warrant any kind of services of any kind of SmartVestor Pro and makes no claim or pledge of any result or success of preserving a SmartVestor Pro - https://fortitudefg-1.jimdosite.com/. Your use the SmartVestor program, including the choice to retain the services of any kind of SmartVestor Pro, is at your sole discernment and risk

The Ultimate Guide To Fortitude Financial Group

The call connects supplied attach to third-party websites. Ramsey Solutions and its associates are not responsible for the accuracy or dependability of any type of info consisted of on third-party internet sites.

No 2 individuals will certainly have fairly the very same collection of financial investment strategies or solutions. Depending on your goals as well as your tolerance for risk and the time you have to pursue those goals, your advisor can help you identify a mix of investments that are appropriate for you and designed to help you reach them.

An advisor can stroll you via lots of complicated monetary choices. As you come close to retirement, you'll be encountered with essential decisions concerning exactly how lengthy to work, when to assert Social Safety, what order to take out money from your numerous accounts and exactly how to stabilize your demand for income with making certain your cash lasts you for the rest of your life.

A person who can help them make feeling of all of it. "Your expert is best made use of as a partner that has the experience to assist you navigate the opportunities and obstacles of your economic life. The financial method your advisor will certainly help you produce resembles a personal economic guidebook you can adhere to and adapt to seek your goals," states Galinskaya.

Fortitude Financial Group for Dummies

Report this page